[Offers contained within this article may no longer be available]

The Citi Double Cash and Chase Freedom are two of the best cash back cards out there. For travelers, it can be kind of confusing when choosing between cash back cards, especially when one has the potential to transfer points to travel partners. This article will review the Citi Double Cash, Chase Freedom, and Chase Freedom Unlimited, and show why you may want to choose one credit card over the other.

Basic features

Citi Double Cash

- No Annual Fee

- 13.24% to 23.24% APR, based on your creditworthiness.

- Balance Transfer Fee Either $5 or 3% fee of the amount of each balance transfer, whichever is greater.

Chase Freedom and Chase Freedom Unlimited

- No Annual Fee

- 0% Intro APR for 15 months on purchases. After the intro period, a variable APR of 14.24%, 19.24%, or 23.24%.

- 0% Intro APR for 15 months on balance transfers. After the intro period, a variable APR of 14.24%, 19.24%, or 23.24%.

- Balance transfer fee is 5% of the amount transferred with a minimum of $5.

Cash back Earned

Each card has its own way of earning cash back. Here are the differences:

Citi Double Cash

- Earns 1X on all purchases and another 1X on those payments when your monthly bill is paid on time. This amounts to a 2% return.

- No sign-up bonus

Chase Freedom Unlimited

- Earns 1.5X Ultimate Rewards on all purchases (which functions as cash back)

- Earn a $150 bonus after you spend $500 on purchases in your first 3 months from account opening.

- Earn a $25 bonus when you add your first authorized user and make your first purchase within this same 3-month period.

Chase Freedom

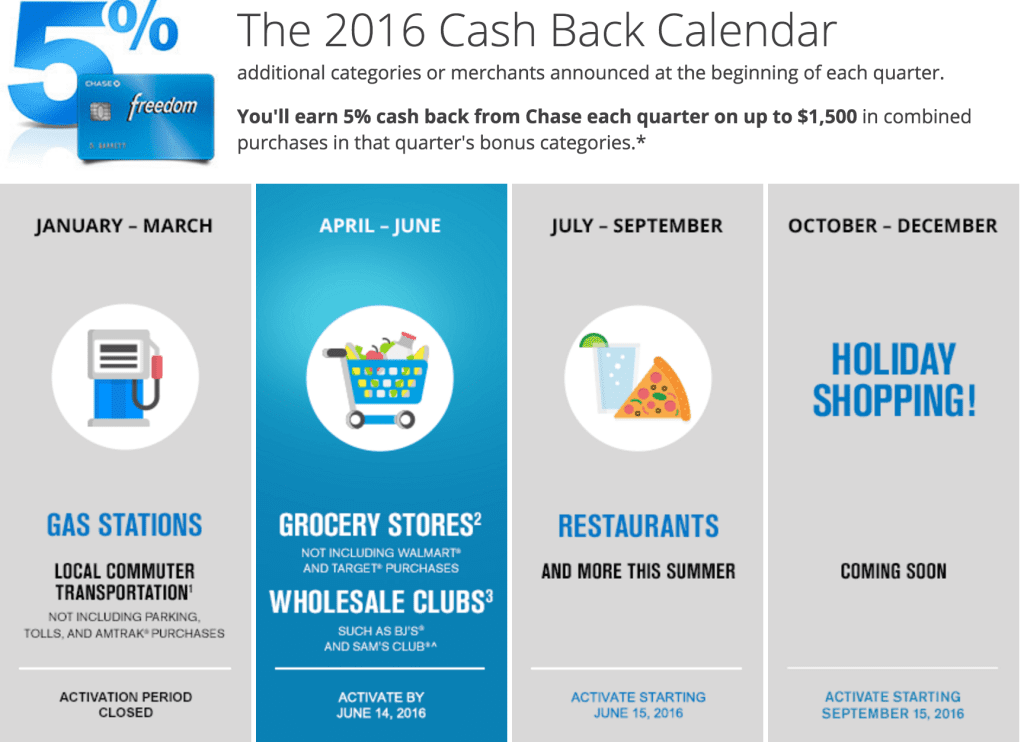

- Earns 5X on rotating bonus categories up to $1,500 per quarter.

- Earn a $150 bonus after you spend $500 on purchases in your first 3 months from account opening.

- Earn a $25 bonus when you add your first authorized user and make your first purchase within this same 3-month period.

How far can you max out the Chase Freedom bonus categories?

Because the Freedom earns 5X up to a certain limit on rotating bonus categories, you need to think about how much you would spend on any of these given categories throughout the year in order to gauge which card would work best for you. Ask yourself the following question:

Can I spend $6,000 annually in the following ways:

- $1,500: Gas, local commuter transportation

- $1,500: Grocery stores

- $1,500: Restaurants

- $1,500: Amazon.com

It might seem unrealistic to max out these categories but for many it isn’t. Usually, those are people who know how to utilize gift cards and eat out a whole lot or are able to cover the bill for meals and drinks (and then get paid back). Also, something to consider is that Chase has offered 10x on the Amazon quarter, allowing a lot of people to exceed the total earning potential or at least make up for other quarters where their spending lacked.

Still, I think the average person probably would fall somewhere in the middle. Thus, I’m going to compare the three cards based on spending habits that would either 1) max out the bonus categories or 2) halfway max out the bonus categories.

Here goes…

I. FIRST YEAR COMPARISON

(The first year comparison will factor in the sign-up bonuses (SUB) for the Freedom cards.)

1. Maxing out Freedom bonus categories

If you spend $10,000 perfectly maxing out rotating bonus categories.

- Citi Double Cash: $200

- Chase Freedom: $340 + (SUB $175) = $515 (Huge winner)

- Chase Freedom Unlimited: $150 + (SUB $175) = $325

If you spend $25,000 perfectly maxing out rotating bonus categories.

- Citi Double Cash: $500

- Chase Freedom: $490 + (SUB $175) = $665

- Chase Freedom Unlimited: $375 + (SUB + $175) = $550

Thus, the results are quite clear here. If you max out the rotating bonus categories and hit the sign-up bonus the top earning cards are:

- The Freedom (by a long shot)

- The Freedom Unlimited

- The Citi Double Cash

However, many people don’t max out the bonus categories on the Chase Freedom so let’s see what happens when you only meet half of the maximum allowed on the bonus categories.

2. Halfway maxing out Freedom bonus categories

If you spend $10,000 perfectly halfway maxing out rotating bonus categories.

- Citi Double Cash: $200

- Chase Freedom: $220 + (SUB $175) = $395

- Chase Freedom Unlimited: $150 + (SUB $175) = $325

If you spend $25,000 perfectly halfway maxing out rotating bonus categories.

- Citi Double Cash: $500

- Chase Freedom: $370+ (SUB $175) =$545

- Chase Freedom Unlimited: $375 + (SUB $175) = $550

Findings after first year of spending:

If you are going to hit the maximum allowed spend for the rotating bonus categories:

- The Chase Freedom blows away the competition at $10,000 and $25,000 spend!

If you are only going to hit about half of the maximum allowed spend for the rotating bonus categories:

- The Chase Freedom still blows away the Citi Double Cash at $10,000 but it’s a lot closer at $25,000.

- The Freedom Unlimited is the top earner, though virtually tied with the Freedom, at $25,000 in annual spend.

This is a very interesting comparison but we all know that we like to keep our cards longer than one year and we don’t earn sign-up bonuses every year (retention offers aside). Thus, let’s take a look at how these earnings measure up after the first two years of spending.

II. SECOND YEAR COMPARISON

A. Maxing out Freedom bonus categories

If you spend $10,000 perfectly maxing out rotating bonus categories.

- Citi Double Cash: $200 + $200 = $400

- Chase Freedom: $515 + 340 = $855

- Chase Freedom Unlimited: $325 + $150 = $475

If you spend $25,000 perfectly maxing out rotating bonus categories.

- Citi Double Cash: $500 +$500 = $1,000

- Chase Freedom: $665 + 490 = 1,155

- Chase Freedom Unlimited: $550 + $375 = $925

The results are quite clear once again: If you max out the rotating bonus categories and hit the sign-up bonus the top earning cards are:

- The Freedom

- The Freedom Unlimited

- The Citi Double Cash

2. Halfway maxing out Freedom bonus categories

If you spend $10,000 perfectly halfway maxing out rotating bonus categories.

- Citi Double Cash: $200 + $200 = $400

- Chase Freedom: $395 +$220 = $615

- Chase Freedom Unlimited: $325 + 150 = $475

If you spend $25,000 perfectly halfway maxing out rotating bonus categories.

- Citi Double Cash: $500 +$500 = $1,000

- Chase Freedom: $545 +370 =$915

- Chase Freedom Unlimited: $550 +375 = $925

The results get shaken up now and the winners need to be broken down.

Findings after second year of spending:

If you are going to hit the maximum allowed spend for the rotating bonus categories:

- The Chase Freedom still tops the competition at $10,000 and $25,000 spend!

If you are only going to hit about half of the maximum allowed spend for the rotating bonus categories:

- The Chase Freedom holds strong at $10,000 spend but gets passed up by the Citi Double Cash and the Freedom Unlimited at $25,000 spend. This gap would only continue to grow each year due to the earning gaps between the cards and the Citi Double Cash would end up dominating.

So let’s run one more test but assume five years of constant spending to see how all of the cards measure up.

II. FIFTH YEAR COMPARISON

A. Maxing out Freedom bonus categories

If you spend $10,000 perfectly maxing out rotating bonus categories.

- Citi Double Cash: $200 X 5 = $1,000

- Chase Freedom: $855 + ($340 X 3) = $1,875

- Chase Freedom Unlimited: $475 + ($150 X 3) = $925

If you spend $25,000 perfectly maxing out rotating bonus categories.

- Citi Double Cash: $500 X 5 = $2,500

- Chase Freedom: $1,155 + (490 X 3) = $2,625

- Chase Freedom Unlimited: $925 + ($375 X 3) = $2,050

The results are quite clear once again: If you max out the rotating bonus categories and hit the sign-up bonus the top earning cards are:

- The Freedom

- The Freedom Unlimited

- The Citi Double Cash

2. Halfway maxing out Freedom bonus categories

If you spend $10,000 perfectly halfway maxing out rotating bonus categories.

- Citi Double Cash: $400 + ($200 X 3) = $1,000

- Chase Freedom: $615 + ($220 X 3) = $1,275

- Chase Freedom Unlimited: $475 + ($150 X 3) = $925

If you spend $25,000 perfectly halfway maxing out rotating bonus categories.

- Citi Double Cash: $1,000 + ($500 X 3) = $2,500

- Chase Freedom: $915 + ($370 X 3) = $2,025

- Chase Freedom Unlimited: $925 + (375 X 3) = $2,050

The results get shaken up now and the winners need to be broken down.

Findings after fifth year of spending:

If you are going to hit the maximum allowed spend for the rotating bonus categories:

- The Chase Freedom wins both $10,000 and $25,000 spend, though it’s very close in the $25,000 spend to the Citi Double Case.

If you are only going to hit about half of the maximum allowed spend for the rotating bonus categories:

- The Chase Freedom wins out in the $10,000 spend but loses by almost $500 to the Citi Double Cash in the $25,000 spend.

Not all points are created equally…

It would appear like the most valuable long-term choice for earning the most back would be the Citi Double Cash. However, that is almost certainly not going to be the case for most travelers, especially for those looking to book business class or first class tickets.

Here’s the reason.

The Citi Double Cash does not earn Citi Thankyou® Points but the Chase Freedom cards do earn Ultimate Rewards. This means that points earned from the Freedom cards can be transferred to travel partners and redeemed for substantially more than 1 cent per point. (You’ll have to have the Chase Sapphire Preferred® or the Chase Ink Plus® to make this transfer so assume one of these cards.)

Why the Freedom cards actually earn more

I’m going to use the example of a recent booking I made to illustrate why the Freedom cards still bring more value to the table for a traveler like me.

I recently used Ultimate Rewards to book a Singapore Airlines first class suite flight from Tokyo to Singapore for 60,000 KrisFlyer miles. I paid $23 in fees.

That ticket would have cost me $5,365… So let’s discount what I paid in cash for fees and we have $5,365 – $23 = $5,342.

$5,342/60,000 = 8.9 cents per point on that redemption!

Recall that if I’m just halfway maxing out the bonus categories on the Freedom in the first year and spending $25,000, that would put the Freedom earnings at 54,500 Ultimate Rewards, or $545 cash back.

That means that at a redemption rate of 8.9 cents per point like the one above, I would get $4,850.50 worth of value from 54,500 Ultimate Rewards, which were earned by spending $25,000. On the other hand, the Citi Double Cash would only earn me a maximum of $500 for the same spend since the Citi Double Cash points can’t be multiplied for more valuable redemptions.

Now, the redemptions won’t always be so sweet and I’m admittedly using an extreme example, but it’s very easy to consistently net more than 2% cash back earnings when earning Ultimate Rewards with the Freedom cards and subsequently transferring them to Ultimate Rewards travel partners.

Thus, for those seeking to use their savings for travel, the Freedom cards will bring you more value than the Citi Double Cash most of the time. And if you’re interested in high-end business or first class fares, the competition isn’t even remotely close.

(Note: The annual fee for the Chase Sapphire Preferred® is ignored in this instance because I believe the Sapphire Preferred®sign up bonus would offset the cost of the annual fee in any event.)

Conclusion

Now, yes, my findings ignore certain variables like the freedom (no pun intended) to do what you want with your cash and what not, but this article is geared towards travelers that likely have their eyes set on travel redemptions, particularly with high-end business and first class suites.

When you make the comparison from that perspective, the Citi Double Cash card really isn’t close at all to the Freedom cards and the question becomes which Freedom card is the best for your individual spending habits. As seen above, the answer to that question depends on how you utilize the bonus category spending and what level of overall spend you put on the cards.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I’m new to the reward credit card game (both cash back and miles). I recently saw the new JetBlue card offered by Barclaycard and thought it was a no brainer so I signed up for that since I love JetBlue. After much research and discussing with family/friends who travel a lot, I’ve come to the conclusion that the combination of Chase Sapphire (for 2x on travel & dining), Chase Freedom (5% in categories), and Chase Unlimited (1.5% on all other purchases) is hard to beat. My goals for earning travel rewards are in line with yours – to score first class international tickets for my future wife and I. This article really simplified things in my mind for me because I’ve been debating whether or not to get the Citi Double Cash.

It just makes so much sense once you know WHY you are doing it all. If all you want is cash back, then the Citi card seems to be best long term. However, as you’ve shown, the Freedom + Unlimited combo performs pretty highly AND aside from having the choice of taking the cash back you have the ability to transfer the points to UR partners for amazing value. Thanks again.

Also, I have a silly question. If I plan to earn UR points using a Freedom and Unlimited for a couple of years before getting the Sapphire to transfer to partners, is that a good plan? I don’t really see the need to redeem UR points for international first class travel for at least another 2 years with where I am in life right now.

Hi there, I’m glad you found my article helpful.

And yes you’re right, the combination of the Sapphire Preferred, Chase Freedom, and Chase Freedom Unlimited is very hard to compete with. If you’re able to add in one of the Ink cards it’s even more of a runaway favorite in my opinion.

I don’t think your proposed plan is a bad plan if you know you’re not going to redeem with travel partners for another couple of years.

However, if you think you might be interested in other cards in the next two years you might need to re-think your strategy. When you apply for the Chase Sapphire Preferred (CSP), you’ll have to make sure you don’t have 5 or more accounts opened within the past 24 months. It’s very possible that as you get more into this hobby, you’re going to come across cards that will have amazing offers you’ll want to jump on (e.g., Amex platinum 75K-100K offers) but you won’t be able to jump on many of them if you’re holding off for the CSP. If you are absolutely sure you’re just interested in the redemptions from UR partners two years from now then it’s not that big of an issue, but just keep the 5/24 Rule in mind when waiting to apply for the CSP.

On the flip-side, you could apply for other cards now since you’re already planning on waiting 2 years to get to the CSP. The risk might be be that something more restrictive might change in the next two years with respect to the 5/24 Rule, although I highly doubt that will be the case.