[Offers contained within this article may no longer be available]

It can be a bit tough when you’re a student trying to build up your credit and get into the credit card rewards game. You likely don’t have the credit profile to get approved for a premier travel card but you don’t necessarily want to start at the bottom with a secured credit card. One good option is to look into credit cards for students. There are plenty out there, but here’s a review of what I think are the top two student credit cards: the Discover it® Student and Chrome cards.

Discover it® Student Cards

There are two different Discover it® student cards to choose from and they both are pretty nice.

Discover it® Chrome for Students card

- No annual fee

- 2% cash back at gas stations and restaurants up to the quarterly maximum ($1,000)

- 1% cash back on all other purchases (with no cap).

- Discover matches all the cash back you’ve earned at the end of your first year (for new cardmembers only)

- Get $20 cash back each school year your GPA is 3.0 or higher for up to the next 5 years(offered once per year).

- 0% Intro APR for 6 months on purchases.Then 13.24%-22.24% Standard Variable Purchase APR applies.

Discover it® for Students card

- No annual fee

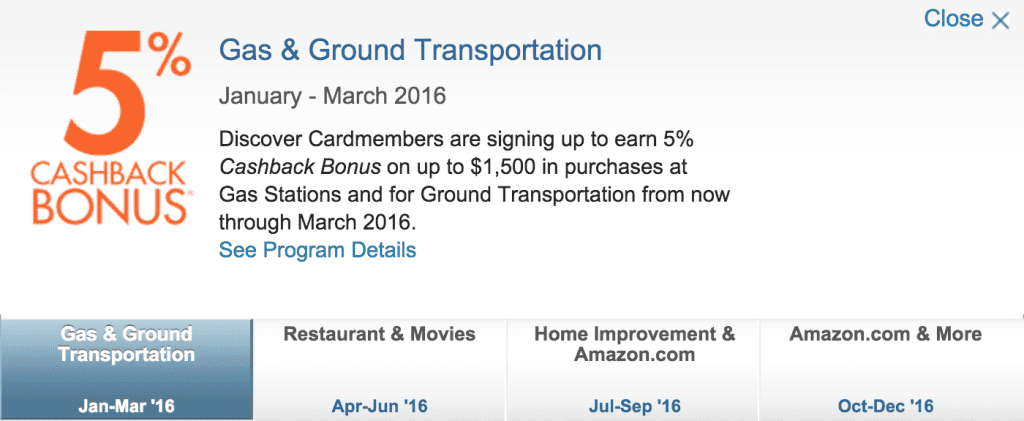

- 5% cash back in categories that change each quarter, up to the quarterly maximum ($1,500)

- 1% cash back on all other purchases (with no cap).

- Discover matches all the cash back you’ve earned at the end of your first year (for new cardmembers only)

- Get $20 cash back each school year your GPA is 3.0 or higher for up to the next 5 years (offered once per year).

- 0% Intro APR for 6 months on purchases.Then 13.24%-22.24% Standard Variable Purchase APR applies.

Some other benefits that these cards boast:

- No late fee for your first late payment

- Paying late won’t raise your APR

- Free monthly FICO score

- No foreign transaction fees

- Free overnight shipping for card replacement

- Cash back never expires

- “Freeze it” function on phone app allows you to instantly freeze all credit card authorizations at the touch of a button

- 24 hours access to live US representatives

Both of these cards are excellent for students because they are providing you with rewards and benefits that are truly on par with premium travel cards and yet you pay no annual fee. The doubling of all of your points at the end of your anniversary year is stellar as well.

Discover it® Rewards

The rewards program for Discover has several benefits and perks including:

- Redeeming cash back with statement credit or deposit into bank account

- Redeeming for gift cards (starting at $20) with occasional bonus value

- They never expire!

Which Discover it® student is best?

Which of these two cards is better for you will depend on your personal spending habits. If you can max out the 5% rotating categories on the Discover it® , that’s $75 dollars cash back each quarter that will be doubled to $150 for an annual first year gain of $600! Meanwhile, maxing out the Chrome would earn you $20 cash back, doubled to $40 for an annual gain of $160.

As a college student, it’s probably difficult to max out $1,500 in spend on categories like restaurants and movies and gas and ground transportation but the Amazon.com categories might be more realistic for you take full advantage of.

The Amazon.com bonus categories happen to fall right before fall and winter semesters start so you could easily put spend for your books and materials on your card and even if you don’t know which specific text books you’ll need, you can buy Amazon gift credit that you can use later on after you receive your course schedule, syllabus, etc. Moreover, if you have friends who are willing to give you cash for their books, you can always cover their expenses as well!

Thus, I’d probably go with the Discover it® for Students card over the Discover it® chrome, simply because there is much higher earning potential with that card. However, if you don’t like the idea of monitoring rotating bonus categories and a large portion of your expenses consist of gas and dining, the Chrome may be better for you.

Although there are many benefits to both of these cards, it has to be mentioned that since this is a Discover card, that does somewhat limit the merchants that will accept it. This is probably only an issue if you are going abroad or traveling, though. For the average student at an American university, this shouldn’t pose a major issue (90% of US merchants reportedly accept Discover).

Getting approved

This card has mixed reviews when it comes to getting to approved so it’s difficult to state what credit score is needed for approval. Generally speaking, I would say once you are in or near the mid-600s you could take a shot at the card. If your parents or someone else is willing to co-sign on the card, that can help out tremendously. If you get denied, don’t get too discouraged. I would look into getting a secured credit card for a while and then think about reapplying after about 6 months or so.

Overall, Discover is a major player in the credit card world today and when it comes to entry level credit cards, especially student cards, I think the Discover it® Chrome and Discover it® Student are two cards that you can really help introduce a college student into the credit card game.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.