[Offers contained within this article may no longer be available]

A lot of people focus on Chase, Citi, and Amex cards because they have such great airline and hotel transfer partners. But there are several other travel credit cards which are great to use that don’t utilize transfer partners for their benefits and instead provide cardholders with statement credits. The Barclaycard Arrival Plus™ is one of those cards. Here’s a review of some of the perks of this card and why you might want to make room for it in your wallet.

How do the “miles” work?

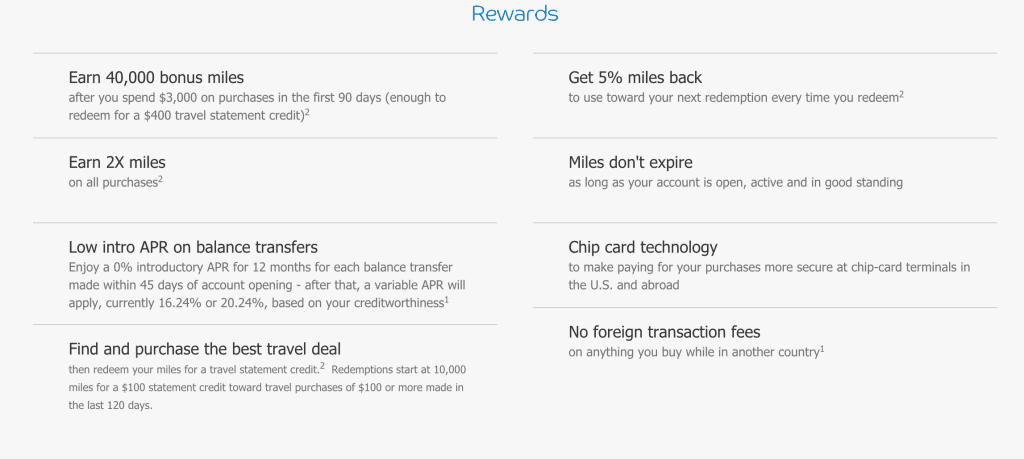

Unlike Chase, Citi, and Amex cards, where you earn points that are transferred to frequent flyer or hotel rewards programs, the Barclaycard Arrival Plus™ works a lot differently. For this card, you earn miles through spending at a rate of 2 miles/per dollar spent. So if you spend $3,000 you earn 6,000 “miles.”

These miles can then be redeemed at one cent per mile after you make a qualifying travel purchase. They can also be redeemed for a general statement credit but the value drops down (by 50%) to .5 cent per point which is not a very good redemption rate at all. Thus, I’d definitely stick to travel redemptions for this card.

Redeeming your miles for travel credits is pretty straight forward. You charge your travel expense to your card and then you have 120 days to log into your online Barclaycard account and select the transaction which you would like to credit your miles toward. Once you redeem your miles, you get the 5% rebate and can apply that to another purchase.

You can read more about the process here. That article is helpful in seeing how easy it is to redeem miles but you should note that two important changes have gone in effect since the publishing of that article.

One, the mile redemption rebate has changed from 10% to 5%, meaning that you’re only earning 2.11 miles as opposed to 2.22 miles. Second, the redemption minimum for miles has increased from 2,500 to 10,000, meaning that the smallest purchase that you can redeem miles for is a $100 transaction. The latter change is really a bummer as it excludes a lot of expenses travelers constantly incur from taxis, busses, etc.

What constitutes “travel” for the Arrival Plus?

Just like some other cards like the Chase Sapphire Preferred or the Citi Thankyou Premier, the travel category for the Barclaycard Arrival Plus™ is quite broad.

Here are the terms taken straight from Barclays:

Merchants in the travel category include airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, trains, buses, taxis, limousines, and ferries.

The Barclaycard Arrival Plus™ used to also include tourist attractions but it seems that vague category proved to be problematic and Barclays removed it. Even without tourist attractions, there’s still a pretty broad amount of expenses that could fall into the travel category, however.

Sign-up bonus

- The current sign-up bonus is for 40,000 miles for spending $3,000 within 3 months. Update: Always check to see if the 50,000 offer is available.

That means that once you hit the minimum spend you’ll have earned 46,000 miles. These miles are redeemed at 1 cent per point for travel so that means you’ll earn the equivalent of $460 worth of statement credit that can be applied against your travel purchases. Not bad. If you’re a traveling couple and the two of you get the card, it’s an easy way to get close to $1,000 worth of travel purchases covered pretty quickly.

Bonus earning potential

The Barclaycard Arrival Plus™ doesn’t earn extra points for certain categories but it does earn 2X miles on every single purchase. That’s not a bad deal, especially if you can end up spending a lot on this card. (And actually, the bonus earning on this card could be argued to be 2.11X since you get an automatic 5% rebate on your redemption.)

Because there are no bonus categories, this is a great card to use for purchases that don’t fall within the bonus categories of your other cards and would otherwise earn 1X.

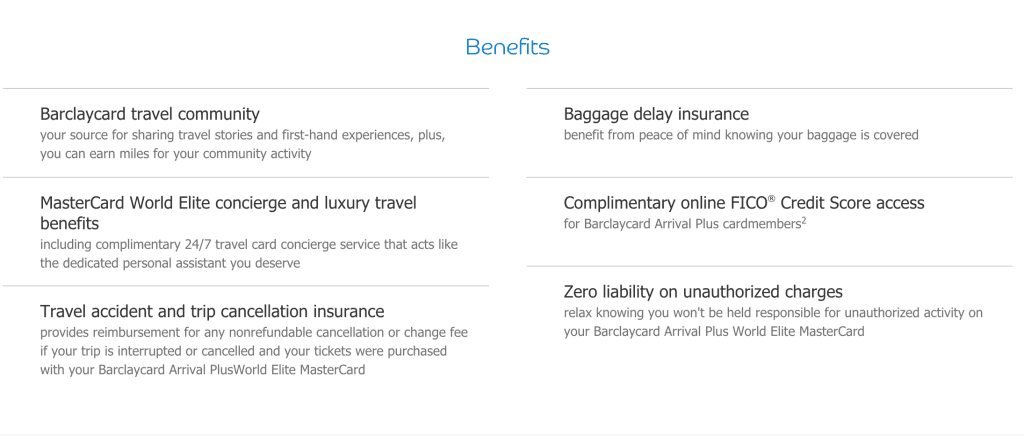

Also, don’t forget about the Barclaycard RewardsBoost. This is a web portal where you can log-in and make purchases with your Barclaycard and earn additional miles on items from a host of different retailers. There’s also the Barclaycard Travel Community, which allows you to earn miles by sharing notes and photos about your travels. You can learn more about these earning opportunities here.

Barclays usually pulls Transunion

One great thing about Barclays is that they almost always pull Transunion for their credit cards. If you pursue Chase, Citi, and Amex cards, you’ll likely get hit pretty hard with hard pulls on your Experian and Equifax credit reports.

Thus, applying for this card can give some of your credit reports a bit of a break when it comes to applying for Chase, Citi, and Amex cards. Moreover, if you’ve got a lot of hardpulls from the aforementioned banks then the Barclays card can always be a good option to go to while you wait for time to distance you from some of your hard pulls.

Note: Barclays may sometimes pull from additional bureaus, so YMMV.

Benefits

- No foreign transaction fees

- Travel accident insurance

- Baggage delay insurance

- Free FICO score

- 0% APR for 12 months on balance transfers made within 45 days of opening the account. (Transfer fee is either $5 or 3% of the amount of each transfer, whichever is greater.)

Annual Fee

- $89, waived the first year

The $89 annual fee is not bad at all since it is waived the first year. However, what really makes it great is that you can downgrade this card to a no annual fee card like the Barclaycard Arrival and help to preserve and improve your average age of accounts and help build up your credit score.

Verdict

The Barclaycard Arrival Plus™ is a good option for a travel credit card if you’re looking for a way to cover those miscellaneous travel expenses like getting to and from an airport in a taxi, rental cars, taking a train between cities, or even trying to cover hotel expenses that can’t be covered by other means. It’s also a great way for couples to quickly accumulate about $1,000 in travel credit. And finally, if you’re worried about hard-pulls adding up from the other big banks like Chase, Citi, and Amex, there’s a good chance you can give your credit report a little break because Barclays will probably pull Transunion.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I applied for the no annual fee Arrival card and I regret it for two separate reasons.

One is that I should have just applied for the Arrival Plus and downgraded before the annual fee was due like you said.

But I regret applying for any of the Arrival cards because of their minimum redemption amount. I feel like it would be too limiting for me and I would be annoyed that I can’t cover certain travel expenses because they don’t meet the limit when that is the whole reason I would be getting the card you know? The Venture card seems to be better in this respect, but then isn’t it better to just get the Citi Double Cash card since both the Arrival and Venture cards seem to be 2% travel cash back cards – limiting with no transfer to partner options

I’m actually in the process of writing up a comparison of the Arrival Plus and Venture One right now but I agree with your stance. The Venture is probably the better option than the Arrival Plus since there is no minimum for redemptions — the $100 minimum for the Arrival Plus really hurts its value.

The Citi Double Cash with its 2X earning is superior in the very long-term for earning cash back but it offers no sign-up bonus. Thus for people who want to snag a quick ~$450 in travel credits, the Arrival Plus and Venture One are better options than the Double Cash.