[Offers contained within this article may no longer be available]

The American Express® Premier Rewards Gold Card and the Citi Thankyou Premier are two of the best travel rewards credit cards available right now. They both offer great earning potential through bonus category spending and pretty good sign-up bonuses as well. Here’s a comparison of the two cards that will give you a better idea of which card is better for you.

Charge card vs Credit Card

Don’t forget that the Citi Thankyou Premier is a credit card and the American Express Premier Rewards Gold Cards is a “charge card.” A charge card must be paid off in full each month or else you face a hefty monthly fee. The benefit to a charge card is that you’re not restricted to a credit limit and so you have a little more flexibility — you just need to be able to keep yourself in check to make sure you’ll pay off your balance in full each month.

Transfer Partners

Citi Thankyou Transfer Partners

Airlines

- Asia Miles (Cathay Pacific)

- EVA Air

- Eithad Guest

- Flying Blue (Air France, KLM)

- Garuda Indonesia Frequent Flyer

- Malaysia Airlines Enrich

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Airways Royal Orchid Plus

- Virgin America Elevate (1,000 pts = 500 Elevate points)

- Virgin Atlantic Flying Club

Hotels

- Hilton HHonors (1,000 pts = 1,500 HHonors Bonus Points )

American Express Membership Rewards Transfer Partners

Airlines

- Delta Skymiles

- Club Premier AeroMexico

- Aeroplan Air Canada

- Flying Blue (Air France/KLM)

- MilleMigilia Club Alitalia

- ANA

- Asia Miles

- Avios British Airways (250 points = 200 Avios)

- Emirates Skyrewards

- Hawaiin Airlines

- Iberia Plus

- JetBlue

- KrisFlyer Singapore Airlines

- Virgin America (200 points = 100 Elevate points)

- Virgin Atlantic

Hotels

- Best Western Rewards

- Choice Privileges

- Hilton HHonors (1,000 points = 1,500 HHonors points)

- SPG (Starwood Preferred Guest) (1,000 points = 333 Starpoints)

I’d probably give a slight edge to American Express for having more hotel partners and for having domestic airline partners like Delta, Virgin America, JetBlue, etc. You can still use some of Citi’s Thankyou partners to book on domestic airlines by booking through alliance partners but it just makes things a little bit more complicated (although a little extra legwork can often save you some miles).

One way that they differ is that Citi allows you to transfer your points to other people – a benefit that makes booking way less of a headache in a lot of scenarios. The only issue with Citi’s transfer policy is that once you transfer the points they expire within 90 days, so make sure you have a plan. Unfortunately, American Express does not offer this benefit.

Just like American Express, Citi sometimes offers temporary specials that offer bonus transfer rates to certain partners. Sometimes these rates will give you great deals like 50% more points when you transfer, so always be on the lookout for them.

It’s important to note that several of these partners are members of both programs like Flying Blue (Air France/KLM), KrisFlyer Singapore Airlines, Virgin, and Hilton HHonors. This makes it really easy to accumulate enough points for business and first class tickets on these airlines.

Point Redemption

You can redeem Citi Thankyou points for gift cards, statement credits, and for travel. Gift cards are redeemed at a value of 1.0 cents per point while statement credits redeem for .7 cents per point. With the Premier you can also redeem points for 1.25 cents per point through the Citi ThankYou Travel Center. The deal gets even sweeter if you have the Citi Prestige because you’re able to redeem points at 1.33 cents per point for any airline and 1.6 cents per point on American Airlines.

Membership Rewards can be redeemed for between .5 and 1.0 cents per point for gift cards and only .6 per point for a statement credit/charge. If you go through Amex Travel you can redeem at 1.0 cent per point on air fare but only up to .7 cent per point on hotels.

I think Citi definitely wins this category with its much better redemption rates for flights and statement credits, although I pretty much always advise against travelers using points for statement credits and usually don’t recommend redeeming points through these portals.

Tip: Sometimes these travel portals offer decent deals but other times you can find much cheaper rates by going through online travel agencies (Expedia, Booking, etc.) or by booking directly through the hotel.

Sign-up Bonus

Citi Thankyou Premier

- 40K to 50K (currently 40K) when you spend $3,000 in the first 3 months

Premier Rewards Gold Card

- 25K to 75K when you spend $1,000-3,000. The 75K offer is highly targeted and rare and the 50K offer, while also targeted, is far more common to receive.

This comparison is a bit close and really hinges on when you catch the bonus. I think the 50K Membership Rewards for spending $1,000 in 3 months is one of the best sign-up bonuses that I’ve come across, so I would say that’s the winner. However, the standard public offer is 25K and compared to the lowest offer of the Premier (40K) that falls short. Most people value Membership Reward points more than Citi Thankyou Points but even with that in mind, I still say the winner is the Premier since the standard public offer is at least 40K versus 25K.

Tip: Try using Incognito/Private browsing windows on the American Express website to get the 50K offer to appear for you.

Bonus category earning potential

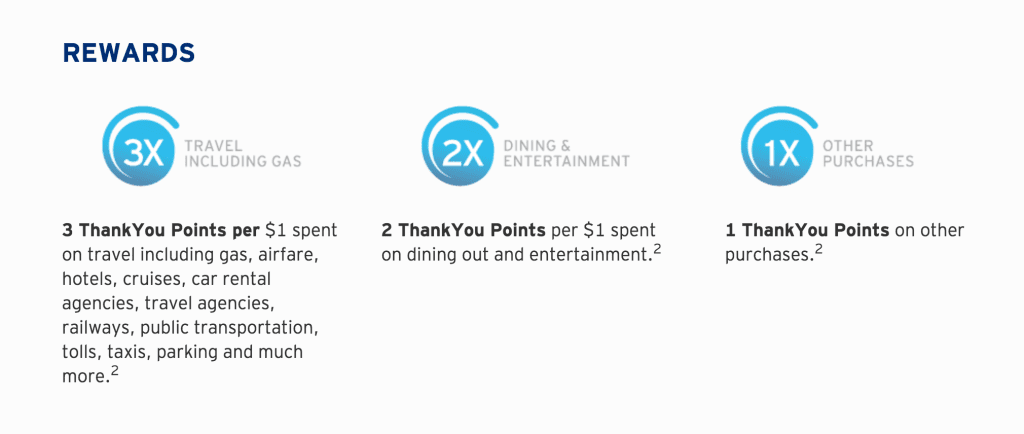

Citi Thankyou Premier

- 3X on Travel (this covers an extremely broad range of expenses).

- 3X on Gas

- 2X on Entertainment (This includes movie theaters, some sport events, museums, tourist attractions, amusement parks, and more)

- 2X on Dining

Premier Rewards Gold Card

- 3X on Airline Tickets (4X through the Amex Portal)

- 2X on Dining, Groceries, and Gas

- $100 Airline credit for fees and incidentals

This is a tough comparison because the Premier Rewards Gold Card offers 2X on groceries, a category that many people probably spend a lot on. At the same time, the Premier offers 3X on the following items: airlines, hotels, car rental agencies, travel agencies, gas stations, commuter transportation, taxi/limousines, passenger railways, cruise lines, bridge and road tolls, parking lots/garages, campgrounds and trailer parks, time shares, bus lines, motor home/RV Rental and boat rentals and also offers 2x on entertainment.

That’s a long and valuable list for 3x earning opportunities. Thus, while I like that the the Premier Rewards Gold Card is valuable for those who shop a lot at grocery stores, I think the Premier is the better point earner for the average traveller. (I’d just rely on another card like the Premier Rewards Gold Card or Everyday Preferred so that I’d earn a bonus rate on supermarkets.)

Personally, I use both of these cards so I didn’t have to choose just one and I think it would be a good idea to think about getting both if you are interested in earning both Membership Rewards and Citi Thankyou Points.

Tip: “Amex Offers,” which gives American Express cardholders exclusive discounts and rebates for quality stores, can also add a lot of value to the Premier Rewards Gold Card. On average, I probably save at least a couple of hundred dollars per year by using these offers, so it’s definitely something to factor into your consideration.

No Foreign Transaction Fees

Both cards have no foreign transaction fees.

Annual Fee

Citi Thankyou Premier

- $95 waived the first year

Premier Rewards Gold Card

- $195, waived the first year

The Premier Rewards Gold Card’s annual fee is essentially reduced to $95 if you can make good use of the $100 annual airline credit. Still, it’s nice to not have to jump through hoops to get the annual fee down to $95. Thus, I’d give Citi a slight edge for the annual fee.

Final Verdict

I think the winner is the Citi Thankyou Premier, although I wouldn’t recommend on holding out on the Premier Rewards Gold Card. Again, I’m a big fan of building up points for the big three (Ultimate Rewards, Citi Thankyou Points, and Membership Rewards). Thus, I think it’s good to get on board with at least one good rewards-earning card from each program. Both the Citi Thankyou Premier and the American Express Premier Rewards Gold Card fit that bill.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.