[Offers contained within this article may no longer be available]

Both the Chase Sapphire Preferred and the Citi Thankyou Premier Card are two cards that offer pretty exceptional opportunities for earning and burning points toward travel. In this article, I am going to compare the two against each other by looking at things like travel partners, sign-up bonuses, bonus categories, retention offers, and so on.

While I compare the two cards to each other, don’t think of this as necessarily a “one or the other” decision if you’re thinking about applying for them, as these cards can most definitely be used together to earn points toward a variety of travel partners.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

1. Transfer Partners

The first consideration for any credit card comparison is always what can the points be used for? After all, even the biggest sign-up bonus can turn out to be a headache if you don’t have any practical way to redeem them once you earn them. The good news is that both of these cards allow you great flexibility when redeeming your points.

If you’re not familiar, the Sapphire Preferred earns “Ultimate Rewards” (URs) and the Citi Thankyou Premier earns “Thankyou Points” (TYPs). These are just like American Express’s Membership Rewards, which all allow you to earn points and then transfer them to travel partners as you desire.

So here’s a rundown of the travel partners available for URs and TYPs:

Chase Ultimate Rewards

Airlines

- British Airways Executive Club

- Korean Air SKYPASS

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Hotels

- Hyatt Gold Passport

- IHG® Rewards Club

- Marriott Rewards

- The Ritz-Carlton Rewards.

Citi Thankyou Points

Airlines

- Asia Miles (Cathay Pacific)

- EVA Air

- Eithad Guest

- Flying Blue (Air France, KLM)

- Garuda Indonesia Frequent Flyer

- Malaysia Airlines Enrich

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Airways Royal Orchid Plus

- Virgin America Elevate (Get 500 Elevate points for 1,000 pts)

- Virgin Atlantic Flying Club

Hotels

- Hilton HHonors (Get 1,500 HHonors Bonus Points for 1,000 pts)

Both programs have a lot to choose from but for me, I tend to value the Chase partners a little more. The reason is that I live next to a United and Southwest hub and so I have quick and easy access to their routes from Houston airports. Also, I like using British Airways Avios and URs offer a 1:1 transfer ratio to British Airways.

Citi, on the other hand, has more airlines to choose from and has some of the best airlines out there, like KLM, Air France, Etihad, Qatar, etc… While these are some of the best airlines in the world, I only tend to book with many of the Citi partners on special occasions, like when I’m planning a real extravagant trip. For the majority of my trips I’m headed out of Houston on United, Southwest, or American Airlines. Thus, Citi partners are less of a “go-to” option for me.

However, depending on your travel goals and plans, Thankyou points might be a better fit for you. And that’s what you should really consider. Think about the destinations you’re interested in visiting for your next few trips. Think about what airline hubs are close to you. Think about whether you’re interested in splurging on extravagant first class suites or keeping it simple in economy. All of these considerations will help you narrow down which transfer partners are a better fit for you.

2. Sign-up Bonus

Chase Sapphire Preferred

- 40K to 50K (currently 60K) when you spend $4,000 in the first 3 months

- An additional 5K for adding an authorized user.

Citi Thankyou Premier

- 40K to 50K (currently 40K) when you spend $3,000 in the first 3 months.

Both bonuses are pretty close to each other, depending on when you catch them. Now, just about everyone in the “points scene” values URs a little more than Thankyou points so 50K in Thankyou Points may not necessarily be more valuable than 45K-50K in URs. Generally, it seems that URs are valued close to 2 cents per point, while Thankyou Points tend to trail while being valued at about 1.5 to 1.8 cents per mile.

The valuation methods of these points can be debated over and over but I believe that the exact valuation of these points you go by isn’t as important as how much you value the transfer partners when valuing the points. Don’t get me wrong, these valuations can be good guide posts to make sure you’re not redeeming points at a ridiculous low rate but for me, the intended purpose and need for the points is what I generally focus on.

So with that in mind, I’d say that both cards offer strong bonuses (especially when at the 50K mark) and you should consider how those bonuses will fit into your intended travel plans more than simply how one bonus edges out the other by a few points.

Restrictions for applying for these cards

Just as a reminder, here are a couple of rules to consider when applying for these cards.

The Chase 5/24 Rule

If you have more than 5 new credit card accounts opened up in the last 24 months, you’ll almost always be rejected for this card. Thus, you may want to apply for the CSP before this rule kicks in and that should be a factor in your decision to apply.

The Citi 8/65 Rule

This rule states that you can’t apply for more than 1 Citi card in 7 days (8 to be safe) and no more than 2 Citi cards (including business cards) in 60 days (65 to be safe). Make sure you abide by these rules because in my experience Citi does not depart from these rules very often, if it all.

3. Bonus category earning potential

Chase Sapphire Preferred

- 2X on Travel (This covers a broad range of expenses from tolls, parking, bus fairs, train tickets, and of course, air line tickets. Also, 3X points can be earned via the Ultimate Rewards Travel partner)

- 2X on Dining

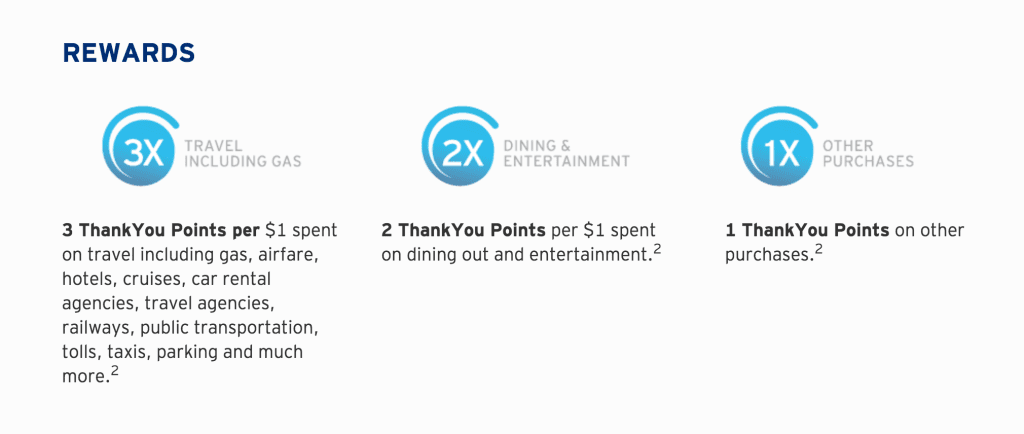

Citi Thankyou Premier

- 3x on Travel (this also covers an extremely broad range of expenses like the CSP but is even a little bit broader!).

- 3x on Gas

- 2x on Entertainment (This includes movie theaters, some sport events, museums, tourist attractions, amusement parks, and more)

- 2x on Dining

It’s pretty clear that the Premier offers more opportunities for earning points in bonus category spending and so it really wins out in this category. (But see the below about utilizing the “Chase Trifecta.”)

Redeeming points for travel

When you redeem your URs for travel purchases, such as airfare, hotel stays, car rentals and cruises through Chase Ultimate Rewards you get 20% off. When you redeem your Thankyou Premier points for travel purchases you get 20% off, as well. This seems like a wash but using Thankyou Points for flight redemptions can actually become more lucrative .

If you also have the Citi Prestige card you can transfer your Premier points to the Prestige and redeem those points toward American Airlines miles at a rate of 1.6 cents and 1.33 cents for any other airline.

This is a pretty decent rate of redemption but it also requires the use of an additional card to take advantage of the benefits. And if we want to include other cards into the discussion, I really think the CSP blows away the Premier due to the earning potential in bonus category spending with the “Chase Trifecta,” essentially turning the CSP into a card that earns 5x phone bills, television, office supply stores, internet, and on rotating categories like groceries and dining.

4. Annual Fees

The annual fees on both of these cards are identical, $95 waived the first year. Another thing that you can do with these cards is downgrade them to annual fee free cards. You’ll just have to make sure that you still have a card like the Citi Prestige or the Chase Ink+, if you still want to take advantage of the travel partners.

5. No Foreign Transaction Fees

Both cards boast no foreign transaction fees.

6. Retention Offers

Retention offers can definitely be hit-or-miss, but here are some of the common retention offers that users can get for each card:

- Citi Premier: Spend $1,000 in 6 months and get 5K TYP.

- Chase Sapphire Preferred: $95 statement credit (Chase can be a bit stingy on offering this)

7. Downgrading

One thing often overlooked when comparing credit cards is your ability to downgrade the credit to an annual fee-free card once you feel like you’ve gotten what you wanted from the card. This helps increase your average age of accounts and saves you a little bit of $ each year.

The Chase Sapphire Preferred can be downgraded to an annual fee-free Sapphire (non-preferred) or even a Chase Freedom. The downside is that you lose out on the ability to transfer your URs to travel partners, unless you also have the Chase Ink+.

The Citi Premier can be downgraded to the annual fee-free Citi Preferred. However, you’ll need the Prestige or Chairman if you still want to transfer to any travel partners.

Conclusion

Overall, I really see these cards as complimentary cards. I have both and use both to earn miles on airlines for different purposes. The Sapphire Preferred is my “daily driver,” and the card I use most often with everyday expenses, but the Citi Premier comes in handy when I want to load up on TPs with gas and entertainment expenses and when I’m trying to book an exotic first class experience on certain airlines.

As stated already, think about your personal travel goals and plans and you’ll be able to see which card is right for you and don’t be afraid to go with both!

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.