The Citi Premier comes with an interesting hotel benefit that can save you $100 on certain hotel bookings. But is this benefit really that valuable or should you pass on using this perk? In this article, I will tell you everything you need to know about the $100 annual hotel savings benefit.

Table of Contents

What is the Citi Premier annual hotel savings benefit?

The Citi Premier $100 annual hotel savings benefit is a special perk that will save you $100 on bookings of $500 or more as long as you make your booking through Citi and comply with other eligibility criteria. Below, I will break down all of the rules and restrictions for using this perk.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Citi Premier overview

Before getting in too deep on the details, it’s a good idea to take a look at the overall package of the Citi Premier.

- Solid welcome bonus (usually)

- 3X on air travel and hotels

- 3X on dining

- 3X on gas stations

- 3X on supermarkets

- 1x on other purchases

- $100 Annual Hotel Savings Benefit

- $95 annual fee

- No Foreign transaction fees

In addition to the great bonus earning potential on dining, gas, and groceries, one thing that should stand out is the $95 annual fee.

That stands out because this benefit can save you $100 which means it is an instant way to come out on top with the annual fee. Sure, it may only be a $5 difference but anytime you can completely neutralize an annual fee with the single use of one perk that is something to be aware of.

Citi Premier annual hotel savings benefit rules

Like most credit card perks, the Citi Premier annual hotel savings benefit comes with a number of rules and restrictions. Luckily, the rules are pretty straightforward so you shouldn’t get surprised by anything. Here’s a breakdown of what you need to know.

Once per calendar year

This benefit can only be used once per calendar year. This means that it will expire every year on December 31st whether or not you put it to use. As far as I know, there is no ability to reinstate this benefit once it expires.

I would recommend that you use WalletFlo to help you to remember to use perks like this.

$100 off a single hotel stay of $500 or more

In order to trigger this discount, you’ll need to book a hotel stay of $500 or more. Keep in mind that this is excluding taxes and fees.

There are a few things to note here.

First, you should absolutely compare prices with booking directly because you might be able to save a good amount of money with member rates, etc. Many times the OTA prices are competitive when compared to booking directly but that is not always the case.

The second thing to note is that because there is a $500 minimum, this discount is not well suited for shorter, cheaper stays. If you typically stay two or three nights at hotels costing around $150 or so, this benefit may become difficult to use.

Book through thankyou.com or 1-800-THANKYOU

You must make your booking through thankyou.com or 1-800-THANKYOU.

The big factor to consider here is that your booking will amount to a typical OTA booking. This means you will almost certainly lose out on elite night credits and points for your stay.

You may or may not receive your elite benefits like free breakfast, upgrades, etc. To maximize your odds of getting those be sure to call the hotel ahead of time and ask them to add your loyalty number to your reservation.

Because receiving elite benefits can sometimes be hit or miss when booking through an OTA, there is a risk that you can lose out on more value than you are saving.

For example, assume you had a four night stay and you would normally be receiving a free breakfast every morning for you and your spouse valued at $40 per morning. Normally, you would be getting $160 in value from breakfast alone but if you pursue that $100 discount you might lose out on that in addition to other benefits like upgrades.

This is one reason why I think this type of discount is best suited for non-chain hotels or hotels that you don’t have any status with.

Prepaid stay

To receive the $100 annual hotel savings, you must pre-pay for your complete stay with your Citi Premier Card, ThankYou Points, or a combination thereof.

The bummer is that you have to pay using your Premier Card if you are not going to use points. This means that you will not be able to utilize things like property credits from other hotel credit cards like the Hilton Aspire or Marriott Brilliant.

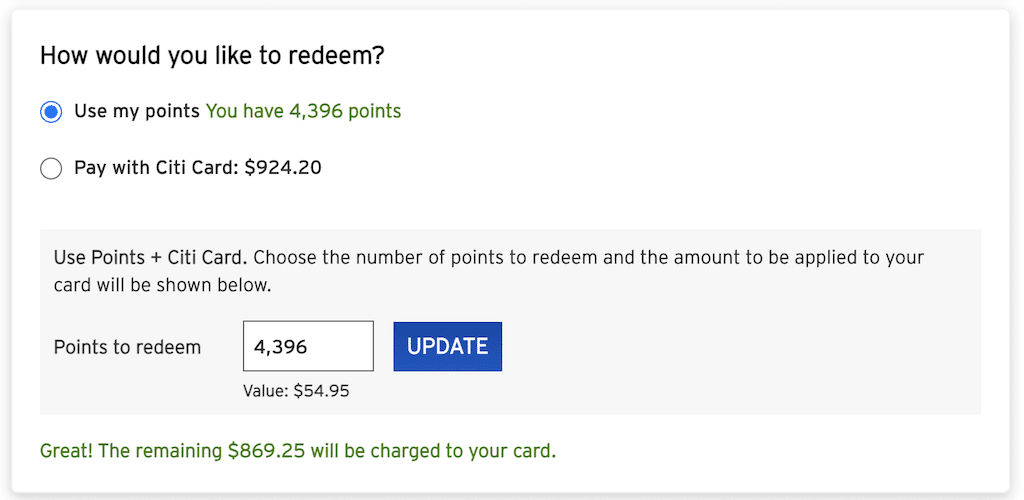

But the cool thing here is that you can use points to cover the booking and receive the discount. When I tested out the perk, it showed me that my 4,396 points were worth $54.95. That comes out to a value of 1.25 cents per point, which is actually not bad at all. That puts it on par with the Chase Sapphire Preferred (at least when it comes to hotel stays).

You could make the argument that with the $100 discount, you’re getting more value from your points.

For example, 32,000 points could get you a $500 hotel stay when you factor in the discount. That would come out to closer to 1.56 cents per point which is pretty impressive but not everyone likes to calculate value that way.

Reservations must be made by the primary cardmember

The reservations must be made by the primary cardmember but you can make reservations in the primary card member’s or authorize users’ name.

Package rates

Packaged rates such as air and hotel or hotel and car rental do not qualify.

Can’t be combined with other offers

Unfortunately, this benefit cannot be combined in the same transaction with the Citi Prestige card’s complimentary 4th night free if you have both the Citi Premier and Citi Prestige cards. This benefit also cannot be combined with any other promotions or discounts on thankyou.com.

How to use the Citi Premier annual hotel savings benefit

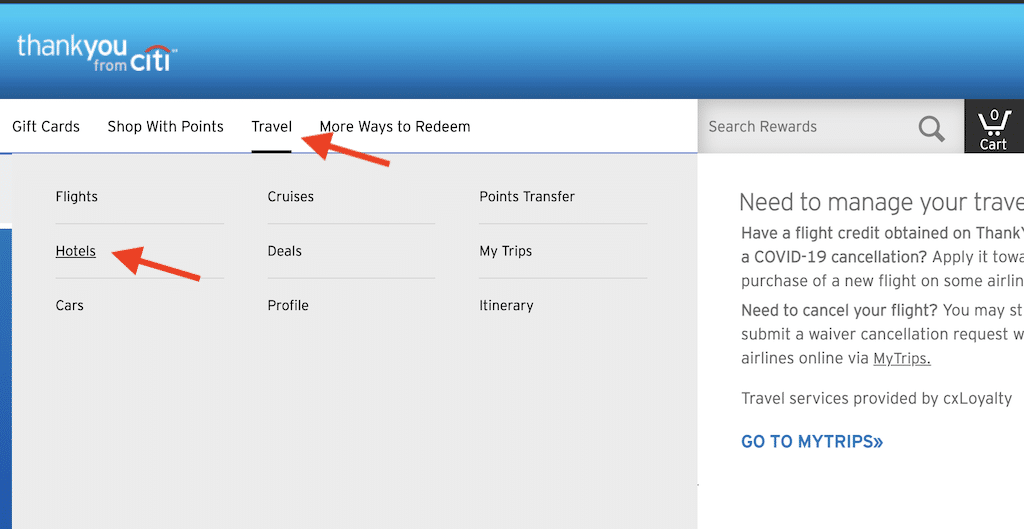

It is very easy to use the annual hotel savings benefit. Simply head over to thankyou.com and log into your account. Click on “Travel” and then “Hotels” on the top navigation bar.

Now, all you have to do is go through the normal booking process. Simply search for the hotel you want to book. If you don’t see your hotel then you can try inserting the name of the hotel chain into the “preferred hotel” field which may show you more results.

If your booking qualifies, meaning that the total of the hotel stay is $500 or more, you will see verification of your discount displayed in the price breakdown (as shown in the image below).

If you would prefer to not use your hotel benefit on the booking, you can simply uncheck the check box that states “apply my annual Citi Premier hotel benefit.” (Citi provides a helpful reminder about the expiration of the perk here.)

Just below that you can choose whether or not to use your points for the booking. In my case, I only had 4,386 ThankYou points and so I could have only used my points to cover a partial payment.

It shows you exactly how much your points are worth and how much of the remaining cost will be charged to your card so it is a helpful and easy to use feature.

Canceling a booking

If you happen to cancel your booking that you used the $100 benefit for, the benefit will remain available for use in that same calendar year.

Final word

Overall, the $100 benefit is an interesting hotel perk but I would make sure to remember the following:

- If you take a lot of short cheap stays with only two or three nights, you might find it difficult to use this benefit.

- If you are interested in earning elite credits and points and/or receiving your elite status benefits you might be losing more value by chasing this discount

- The hotel prices may be higher than booking directly

However, if you are not staying at properties where you have elite status, prices are more or less equal, and your booking price is $500 or more, I don’t see any reason why you wouldn’t want to consider using this benefit.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.