The reality is that in most cases, there’s no quick fix to your credit score. When you make a mistake like missing a payment or falling into delinquency, you often just have to rely on time to pass in order for you to get your credit back on the right track. With that said, sometimes there are some relatively quick fixes. Here’s how to improve your credit score fast.

- Note: It will really help here if you have a basic understanding of credit scores, so if you need to learn on the basics, read my beginner’s guide to credit scores and reports.

How long does it take to improve your credit score?

It generally takes a couple of months to see improvements to your credit score. But you can definitely improve your credit score in 30 days or less depending on factors, such as when statements close, new accounts report, disputes get resolved, etc.

Anything that happens within 30 days is generally considered “quick” for credit repair purposes. But more likely, rebuilding a credit score is going to take several months to a year (or longer) depending on what is holding your score back the most.

Get a “starter” credit card

If you have a poor credit credit score, you’ll likely struggle to get approved for many credit cards.

However, there are many credit cards available for people with bad credit like store credit cards, such as the Zales credit card.

You might only be able to get a secured credit card or a card with low limit, but if you successfully manage the card by making on-time payments, your score will begin to improve relatively quickly, depending on what factors are holding you down. Find out more about credit cards for bad credit scores.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Get added as an authorized user

Adding yourself as an authorized user to a credit card can be a great way to raise your credit score immediately (relatively speaking).

Becoming an authorized user can improve your credit score by doing these things:

- 1) Lowering your credit card utilization

- 2) Improving payment history

- 3) Increasing the average age of accounts

- 4) Diversifying your credit (this factor plays a very limited role).

To maximize the benefits of being added as an authorized user, your goal should be to get added as an authorized user to an account that:

- 1) Has as close to 0% utilization as possible

- 2) Has flawless payment history and no negative reports

- 3) Is older than your average age of accounts.

Depending on which of these factors is bolstered by being added to the new credit card, you score may jump anywhere from a few points to up to 20 points. I’ve even seen reports where some scores shot up by 50 points! In my experience, scores don’t improve much more than 20 points, but it all depends on the specific factors of your score that you’re addressing.

It’s really difficult to boost your credit score overnight but you can expedite the benefit of being added as authorized user by requesting the credit card to be expedited (if it’s free) and by activating it as soon as it arrives in the mail. You also should make sure the social security number is added so that it will report to the credit report.

Balance transfer to business credit card

The strategy here is to transfer a credit card balance to a business card because most business card balances to not report to your personal credit report. So while you’re still responsible for paying the balance, it’s almost like that balance doesn’t exist for purposes of your credit report.

A perfect example of this is the American Express Blue Business Plus Credit Card. It’s a business card offering 2X on all purchases for the first year, no annual fee, and best of all 0% APR on balance transfers for a limited time.

You’ll need to have decent credit to get approved for this card. However, if you have a low overall credit limit that has high utilization, this could be perfect for you, since it will effectively wipe away that utilization from your credit score. Again, just make sure that the business card won’t report to your credit report.

Consolidate your revolving credit into an installment loan

This is my #1 trick I offer to people who have high credit utilizations and are trying to learn how to improve their credit score fast. I’ve seen it work wonderfully for many people, too.

This is how this trick works.

Revolving accounts and installment accounts

For the most part, there are two different types of accounts you can have. Revolving accounts and installment accounts. Revolving accounts are going to usually be accounts from credit cards, department store cards, trade/credit lines at retailers, some personal loans, and so forth. Installment loans are typically large loans like student loans, car loans, home loans, etc.

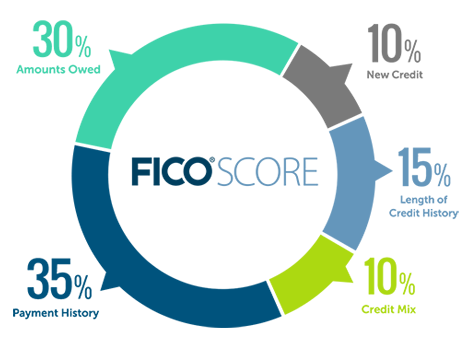

The difference between these two is that revolving accounts directly affect your credit utilization while installment accounts do not. This is very key because your utilization makes up a whopping 30% of your FICO score.

So you may already see what can be done here.

Transfer from revolving to installment

By transferring your debt from revolving accounts to an installment account, you effectively remove your debt from the equation that affects your credit score utilization and therefore can often raise your score substantially if your credit utilization is what was holding you back. I’ve seen people raise their credit scores by 100 points overnight with this method by bringing maxed-out credit utilization down to 0%.

I generally recommend for people to do this by going into local credit unions or banks that they have good relationships with. If you have a decent score, somewhere in the upper 600s, you probably won’t have a problem getting a personal loan for debt consolidation or just for “personal use.”

Make sure that you’re getting an installment loan and not a revolving line of credit.

Goodwill letters

Your payment history makes up 35% of your score and is therefore the most important factor in your credit report, so it’s vital to take care of this factor.

If late payments or delinquencies are holding you back, then trying a goodwill letter might be one of the best ways to quickly improve your credit score.

Goodwill letters are short letters you send to the lender explaining to them your situation of why your payment was late. Whatever hardships you were experiencing at the time should be mentioned. The success rate on these is mixed, but it’s worth giving it a try, since you have nothing to lose.

- You can read my guide on writing goodwill letters here.

If you have a late payment in collections, it’s rare that a collections agency is going to entertain your good will letter. In these instances, it pays to negotiate. I was able to get on the phone one time with a collections agency for a client and get the them to agree to remove the late payment entirely from the report and in exchange for a payment, which was about 40% of the total debt due. Again, this is another route that is met with mixed success and it can also be a little bit pricey, so it’s not for everyone.

However, if you go this route, I suggest you get something in writing from them guaranteeing the complete removal of that late payment from all credit bureaus that they have reported to. Otherwise, it’s your word against theirs.

Get errors removed

An Federal Trade Commission (FTC) report found that 21 percent of a representative group of US consumers found a “confirmed material error” in one of the credit reports issued by the big three credit bureaus. This means that you should also check your credit reports for errors. If you see anything you suspect is not accurate, you should definitely attempt to dispute it.

Depending on the severity of the error, you could see a major change in your credit score.

Final word

Overall, it can be difficult to raise your credit score fast. Often time is the only healer for your report. But I’ve seen these options work effectively to improve credit scores quickly for many people, so I know that they can work if you’re able to give them a try.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.