This article contains an expired offer.

A new targeted offer for the Marriott Rewards Credit Card is making its way around via email and it’s offering an upgraded sign-up bonus but also coming with an increased minimum spend requirement. Here’s what you should consider when choosing whether or not to jump on the offer.

Update: Some offers are no longer available — click here for the latest deals!

The offer

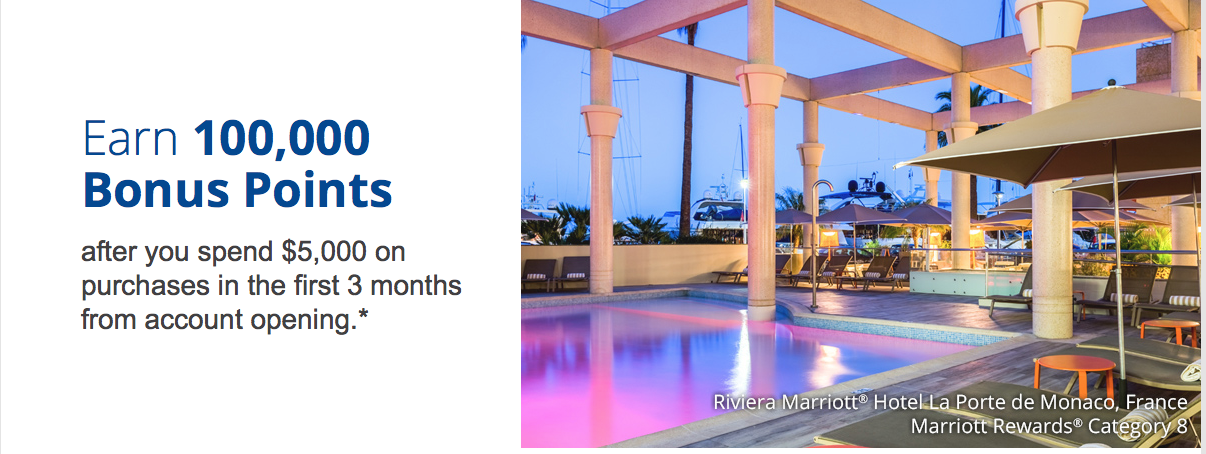

- 100,000 Marriott points after $5,000 spend

- 7,500 points when you add an authorized user

- Automatic Marriott Silver status

- Free anniversary night each year at category 1 through 5 hotels

- $85 annual fee (not waived)

- 5X per $1 spent at Marriott properties

- 2X per $1 spent at air lines, car rentals & restaurants

- Affected by Chase 5/24 but business version is not

Targeted offer

This appears to be a targeted sign-up bonus offer that only select Marriott members are receiving (I received it via email yesterday). However, some have had luck applying on various public links. Note: just because you received this offer via email, that does not mean you can circumvent 5/24 and the rule will likely apply just like it would ordinarily.

If you were approved for a lower offer for this card within the past 90 days you can send Chase a secured message and request to be matched to the 100,000 offer. YMMV though because this offer requires $2,000 more in spend than the standard offer so if you wanted to increase your odds of getting matched, you may want to proactively put $2,000 more spend on the card if it’s not too difficult for you to do.

Sign-up bonus

The standard offer is 80,000 Marriott points after $3,000 spend, so you’re basically spending $2,000 for 20,000 additional Marriott points, which isn’t a bad return.

How far can 100,000 Marriott points get you?

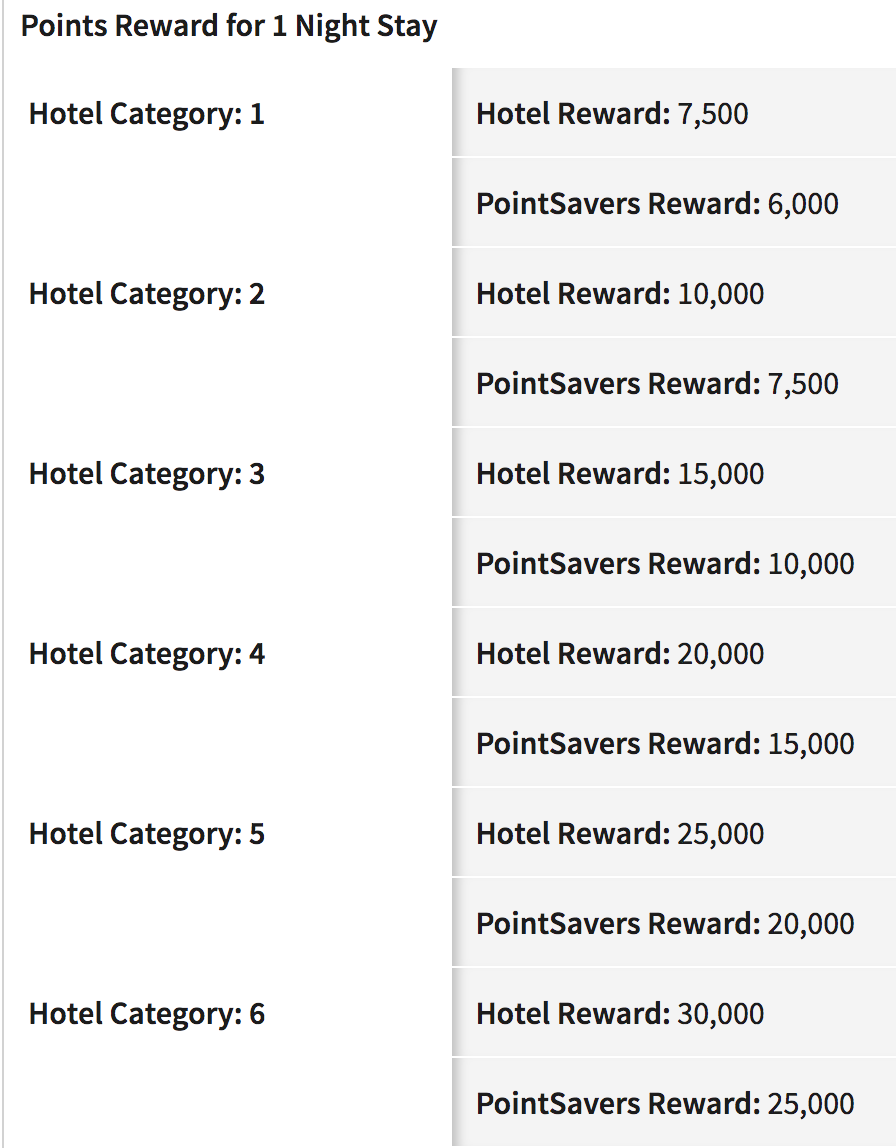

100,000 Marriott points is worth about $800 in travel based on a valuation of .8 cents per point. How far those points could get you all depends on your personal taste. Take a look at the rates for hotel categories 1 through 6 below.

If you wanted to, you could stretch 100,000 points into ten free nights at a category 2 or ten nights at a category 3 if you redeemed for PointSavers awards. Typically, these are hotels like the Fairfield Inn, TownePlace Suites, Springhill Suites, and Courtyards, often located toward the outskirts of major cities. And while these aren’t going to be luxurious properties, some of these hotels can actually be quite nice if you’re just looking to have a place to stay for the night.

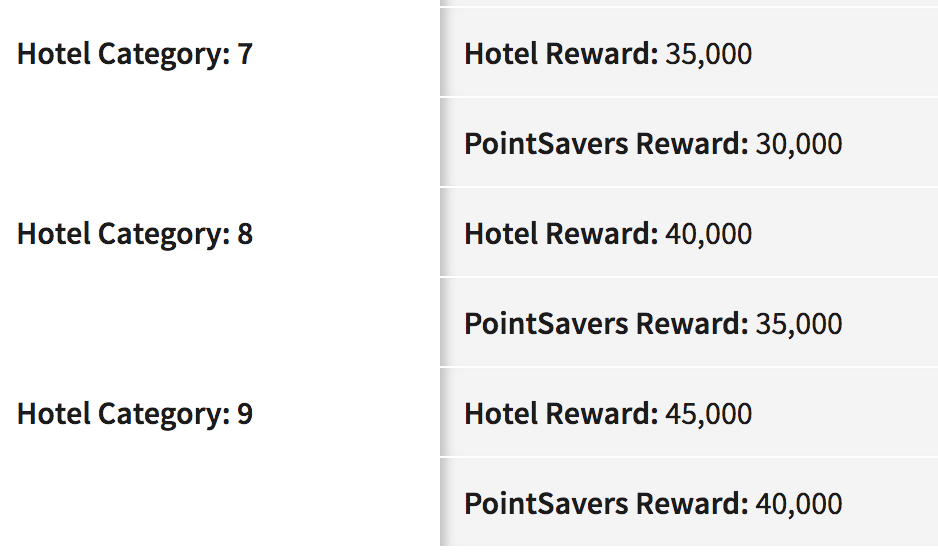

If you wanted to stay at a more luxurious property in a major tourist area, you’re probably going to be looking at at least a category 7 or higher, so you could probably get 2 to 3 free nights out of 100,000 points.

For example, the Marriott Fallsview at Niagara Falls is a category 8 hotel and will require 40,000 points for a standard redemption.

For example, the Marriott Fallsview at Niagara Falls is a category 8 hotel and will require 40,000 points for a standard redemption.

And finally, if you wanted to stay at a top luxury property like a Ritz-Carlton, you’d need to use many more points like 70,000 for a Tier 5 or 60,000 for a Tier 4 property.

Tip: Always consider the possibility of using a flight + hotel package as they often offer the best value for your Marriott points.

Annual fee

This card comes with a $85 annual fee that is not waived.

If you’re trying to earn Marriott points and avoid an annual fee, you should be aware that you could also apply for an SPG card which would net you 40,000 SPG points after meeting the minimum spend of $5,000 to earn 35,000 SPG points.

Those 40,000 SPG points could then be transferred to Marriott at a 1:3 ratio so that you’d end up with 120,000 Marriott points without having to pay an annual fee (the first year). It’s a great option if you’re not eligible for this card due to 5/24.

Free anniversary night

Something that the SPG card does not offer is a free anniversary night, however.

The Marriott card offers a free anniversary night that it is limited to Marriott categories 1 through 5 (you only get the free night after you pay the annual fee).

You can find category 5 hotels worth close to $300 per night but those are hard to find in my experience, especially since Marriott pushed more hotels into higher categories in 2016. More than likely your value will be closer to $150 to $200 for top properties. For example, I recently considered booking the Marriott Courtyard in St. George, Utah (a category 5) that was going for $220 on a weekend night.

In that instance, holding on to this card is like paying $85 for a $200+ night each year at a Marriott, which I think would make this card a keeper for many people.

Bonus categories

The Marriott Rewards Credit Card is actually not the best card for earning Marriott points with bonus categories. In many instances, you’ll net more Marriott points by using the SPG card, Chase Sapphire Reserve, and even cards like the Platinum Card or Amex EveryDay Preferred to make your purchases. So keep that in mind when evaluating the bonus categories for this card.

- 5X per $1 spent at Marriott properties

- 2X per $1 spent at air lines, car rentals & restaurants

Elite benefits

- You’ll receive 15 Elite credits after account opening and every year after your account anniversary, giving you guaranteed Silver Elite status every year.

- Every $3,000 you spend on purchases earns you 1 additional credit toward Elite status – with no limit to the number of credits you can earn.

The guaranteed Silver status is a nice perk, although since I get automatic Gold status through the Platinum Card from American Express (via SPG Gold), this doesn’t do too much for me.

Final word

If you’re below 5/24, this is definitely an offer worth considering since it’s such a high sign-up bonus and for many people the Marriott card is a keeper due to the free anniversary night.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.