[Offers contained within this article may no longer be available]

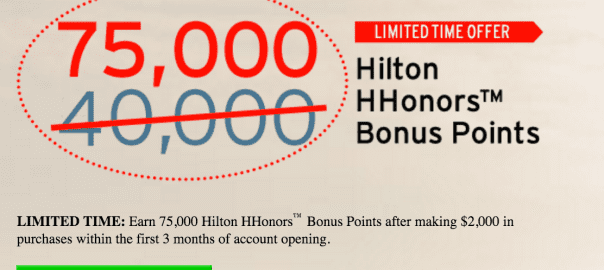

The Citi Hilton HHonors Visa Signature Card offer is back where you can earn 75,000 HHonors Points after making $2,000 in purchases within the first 3 months of account opening. This comes right after the Citi Hilton Reserve offer for two free nights and a $100 statement credit. I’ve recently written about both of these offers but I’m just going to touch on them again.

Here are the perks of the Citi Hilton HHonors Visa Signature Card that just came out today.

- No annual fee

- Earn 75,000 HHonors bonus points after you spend $2,000 in the first 3 months.

- Silver HHonors status and fast track to HHonors Gold status after four stays within your first 90 days of account opening or when you make $20,000 or more in purchases each calendar year

- Earn an annual loyalty bonus of 10,000 Hilton HHonors Bonus Points at the end of each calendar year in which you spend $1,000 or more on stays within the Hilton Portfolio

This card also offers bonus category earning in the following ways:

- Earn 6 HHonors bonus points for every dollar spent within the Hilton Portfolio

- Earn 3 HHonors bonus points for every $1 spent at supermarkets, drugstores andgas stations

- Earn 2 HHonors bonus points for every $1 spent on all other purchases.

I think the 75,000 offer for the Citi Hilton HHonors Visa Signature Card is a great offer and it can be even sweeter if you can combine it with the Hilton HHonors Credit Card from American Express that right now has on offer of 50,000 HHonors points. That would put you at 125,000 HHonors points without having to pay an annual fee on either card! I’ve written about these two cards before and explained how much value you could get from the cards.

Which Citi Hilton card should you get?

With the Citi Hilton Reserve offer for two free nights and a $100 statement credit out right now, you might not be sure which card to go for. (You can read about my take on the Citi Hilton Reserve offer here.)

Personally, I think it depends on what your travel goals/plans are.

If you’re looking to redeem for some of the best Hilton properties for a couple of nights, I think the clear answer is that the Reserve is the way to go. That’s because even with the sign-up bonus of 75,000 HHonors Points of the Visa Signature Card, you will still likely be shy of what’s required for just one night at some of the top Hilton properties. But with the Reserve, you could use your two weekend nights to cover hotels that would cost up to 95,000 HHonors Points per night (which could equate to about $2,000 in value)!

And sure, you’re paying $95 for the annual fee for the Reserve but with the $100 statement credit (for Hilton expenses) and with Gold status, you’re still netting some decent value that, depending on your spending habits, could completely cancel out your annual fee. And don’t discount the value of free breakfasts and potential upgrades.

On the other hand, if you’re looking to stretch your points into maybe a three night (or more) stay or you just want to have the freedom to book nights during the week, the Citi Hilton HHonors Visa Signature Card is probably a better option. This is especially true if you’re wanting a no annual fee card that you can open for years to come to help build your credit history.

Final word

Ultimately, if you’re trying to cover more than a couple of stays at “average” Hilton properties, I say go with the Citi Hilton HHonors Visa Signature Card and seriously consider going with the Hilton HHonors Credit Card from American Express to beef up your balance of HHonors points. But if you’re trying to go the high-end luxury route think about getting on with the Hilton Reserve.

Hat tip to Reddit.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.